On October 2, 2019 brokerage firm Charles Schwab announced they were no longer going to charge commissions on stock and ETF trades. Before the day closed E-Trade and TD Ameritrade followed suit. And just like that, commissions were dead.

6 years earlier, Robinhood launched the first commission-free trading app. It was very simple, only supported individual taxable accounts, and you could only fund accounts via ACH. Despite (or perhaps due to) the simplicity, it was a smash hit, opening over 6 million accounts in less than 5 years. It was only a matter of time until Schwab’s announcement.

Commissions have always been a bad idea. Brokerages make money on so many other things, commissions were mostly just a guise. A sleight of hand, making you believe the “cost” was $6.95 a trade. Would you believe they can make nearly 20x more money on the things they don’t tell you about? It’s true.

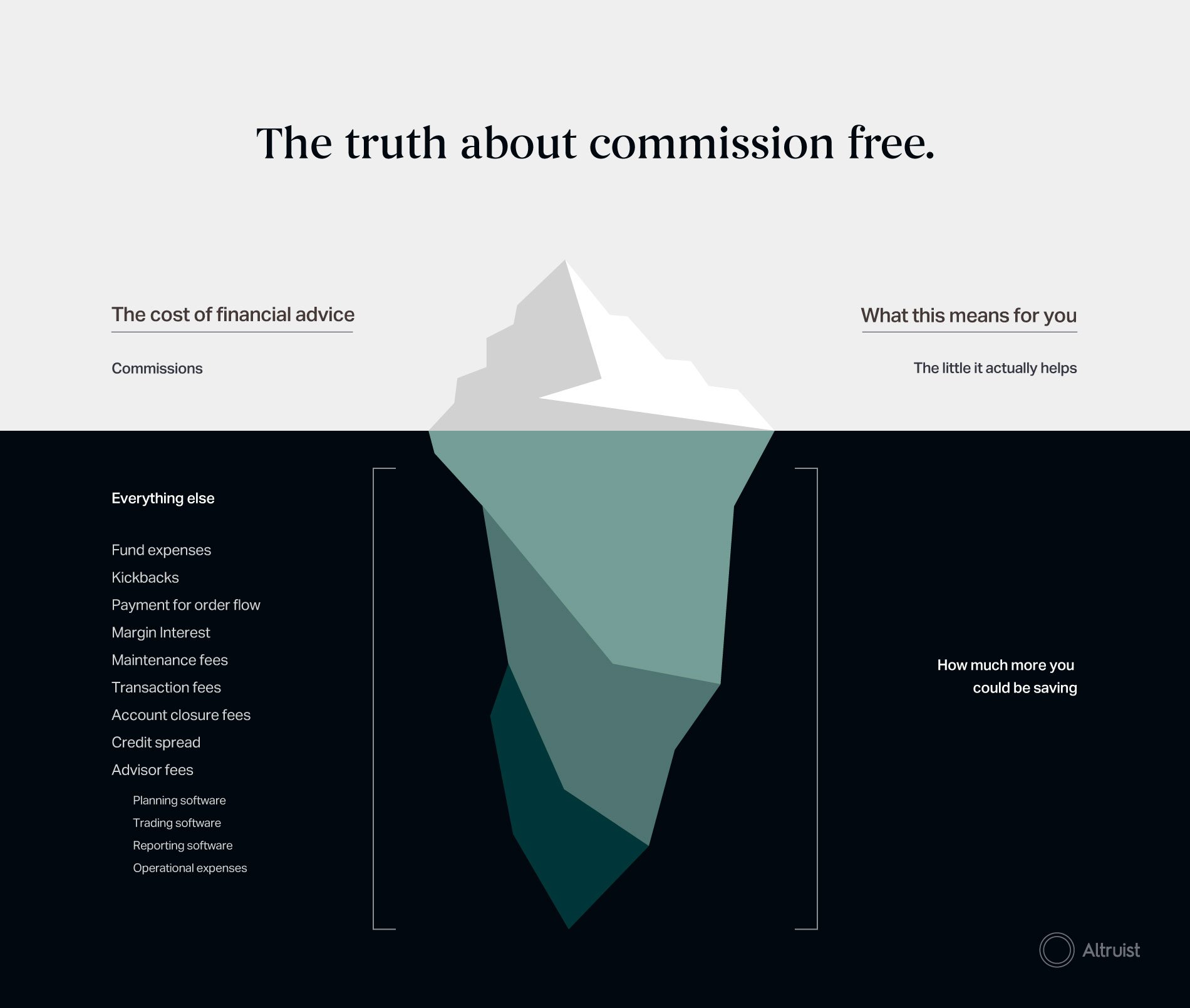

So while the death of commissions is long overdue, it’s just the tip of the iceberg. It’s smoke and mirrors.

Killing commissions makes trading cheaper. It only marginally makes financial advice cheaper and it barely makes financial outcomes better. It will take more for financial advice to get better. Much more.

What’s commission-free really worth?

It’s a start. But it barely changes outcomes. Let’s take a look at how much commissions alone add up for a typical client of a financial advisor.

|

Trades year 1 |

Trades year 2+ |

|

|

Stocks |

5 |

2 |

|

ETFs |

10 |

4 |

|

Mutual Funds |

5 |

2 |

In this example, we have an investor opening a new account and buying 5 stocks, 10 ETFs, and 5 mutual funds. After the first year, there is some ongoing management or rebalancing, which equals out to 2 stock trades, 4 ETF trades, and 2 mutual fund trades. We’ll assume the stock and ETF trades were $6 before commissions were waived.

By paying no commissions on the stocks and ETFs the investor would save $90 in the first year and $36 each subsequent year. Over 20 years that adds up to $774.

If an investor has more than one account they would save $774 for each account, so it’s possible commission-free stock and ETF investing is worth $1,500 or more over the course of 20 years.

Not too bad, but hardly life-changing.

The 95% of the iceberg you can’t see.

In our example above we also show 5 mutual funds in the hypothetical portfolio. Has anything changed with those? Nope. What do they cost? A lot. How else do they make money? In more ways than you can imagine.

Mutual funds are just one part of the iceberg you can’t see.

Custodians make a lot of money from mutual funds. Unless the fund company agrees to pay some type of revenue share it’s not uncommon for the transaction fee to be $40 or more. This is the case with Vanguard mutual funds. They refuse to pay revenue share (so they can keep their expense ratios low for investors), which means brokerage firms ding you for $40+ each time you trade those funds.

Using our above example, if we bought 5 Vanguard funds in year 1 and rebalanced thereafter, causing 2 more trades each year, the 20-year cost would be $1,720.

That’s over 220% more than the savings from commission-free stock and ETF trading!

You could, of course, use no transaction fee (commission-free) mutual funds. But those are even more expensive for most investors. This is because the only way to get mutual funds commission free is for the fund company to pay a revenue share to your broker. This is usually a combination of a flat fee each year in addition to a percentage of revenue the fund company earns, typically 0.25% or more.

Depending on the size of the investment, this can add up quickly.

There’s also a (big) problem in how brokerage firms pay investors that have some of their money in cash. A common practice among the commission-free brokers is to pay around 0.1% on your cash balance while they earn ~2%.

Some will say, “just don’t hold cash in investing accounts.” Normally accurate, but the commission-free brokers don’t want you fully invested. To make it hard, they only allow commission-free on stocks and ETFs, which they only allow you to buy in whole shares.

What this means is if you want to buy Apple (AAPL) you need to buy it for $227 a share. If you have $300 in your account you end up with $73 in cash. This $73 in cash is about 25% of your total account value. So, without you even realizing it, your broker is making nearly 0.5% per year.

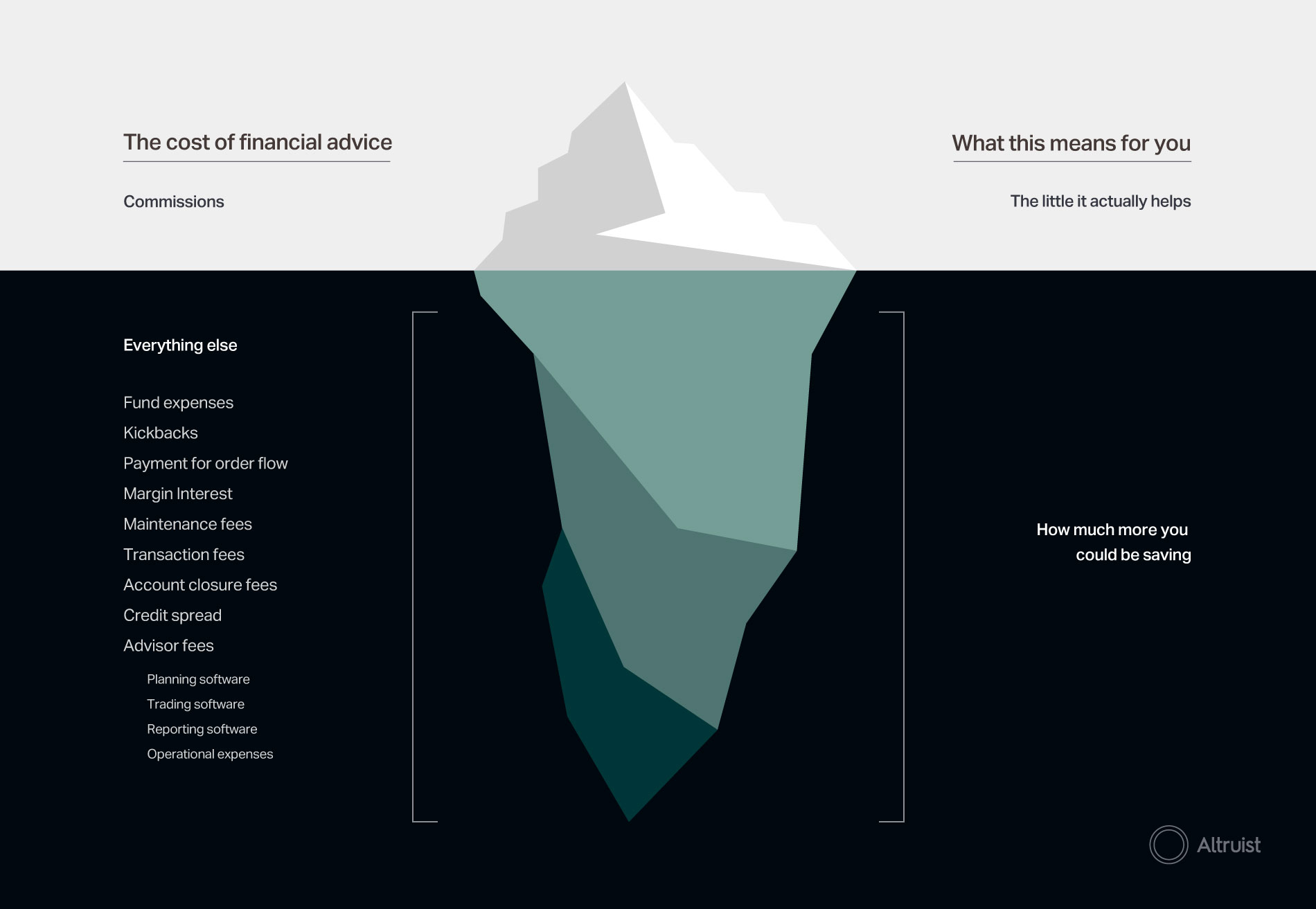

At scale, this adds up. In Charles Schwab’s Q2 2019 earnings they reported earnings of $1.6 billion in net interest (what they make on your cash balance) compared to just $174 million in commissions. Net interest was 59% of their total revenue. Commissions, just 6.4%.

As you can see, brokers love it when you leave cash in your account. And giving you commission free trading on the types of holdings you have to buy in whole shares drives those cash balances higher. Good for them, bad for you.

Other ways custodians make money: margin interest (predatory like at some brokers), securities lending (using your stock to loan it to a short seller), payment for order flow (lets a high frequency trader fill your order rather than the exchange), account maintenance fees (IRAs specifically), wire fees (marking up the cost), and account closing fees (hit you with $100 just to close your account).

Look, some of these fees must exist. Nothing is really free. But, there’s definitely a need for more transparency and in many cases reducing or eliminating these more opaque costs.

When you add it all up, a custodian makes about 0.38% on client assets (1). In some cases that number is much higher. Commissions made up less than 0.02% of that.

How brokers make money

No commissions is good. Scaling financial advice will be seminal.

The average fee for a fee-only financial advisor is about 1% per year. Commission-based (or fee-based) advisors could be cheaper, or way more (more likely the latter). Many of the best advisors have client minimums in the hundreds of thousands, and in some cases, millions. If we really want to help people get more from their money, we need to find ways to make financial advice more accessible and more affordable.

Compressing the cost of advice by ½ would have 25x the impact of eliminating commissions, a life-changing difference for investors. So how do we do that?

First, we have to understand why good financial advice is scarce and rather expensive. It’s not that financial advisors are bad people out there overcharging their clients. Though there are some bad advisors, most are great people who care deeply about their clients.

The issue is running a financial advice business is both time-consuming and expensive.

It’s time-consuming because building financial plans, opening and servicing accounts, watching portfolios, doing ongoing tax planning, doing research and due diligence on investing strategies, and meeting with clients takes time. Not to mention running a small business, managing staff, and marketing for new clients.

Most financial advisors actually spend more time doing non-financial-advice work than financial advising.

It’s also expensive. If you are an employee advisor, the company you work for will take 50% to 75% of your fees. If you are independent, you have to pay for offices, staff, software, marketing, and more.

Yet no one is really making advisors more efficient. This is evident by the fact that the average financial advisor is still charging the same as they were 10+ years ago and has worse margins than they had 10+ years ago.

Sure, there have been a bunch of new software products that claim to make advisors more efficient. The problem is they aren’t. Advisor businesses, as a whole, have actually gotten worse.

In 2009 the median RIA had AUM (assets under management) of $175 million. In 2019 the number is under $100 million. This is largely due to a significant number of new firms (nearly 4,000 new firms started with less than $100 million of client assets). With so many new, smaller firms, margins have declined.

For being a business of financial advice providers, many within the industry haven’t thought much about the economics of their own business.

Major custodians have stifled innovation, rather than advance it. These companies subsidize bad tech for their largest customers while making smaller RIAs pay full price, which makes it challenging for emerging advisors to do great work for their clients. They do this by paying “soft dollars,'' a type of expense reimbursement to their large clients. Often times it allows big firms to get free software.

This hurts both the majority of advisors and the majority of their clients. The big custodian wins because they don’t have to develop in-house technology. Legacy software companies serving advisors stand by without a challenge because they are getting paid directly by the custodians. Nobody wants to step on anyone’s toes, and all the while the average advisor and their clients get stuck with below average software at a high cost.

The result is a fragmented group of small businesses being served by a fragmented group of vendors. Vendor costs, especially technology vendors, are extremely overpriced. Service models aren’t systematized and automation is severely lacking. The result is businesses that have strict limitations on the number of clients they can effectively care for and expenses so high they have no choice but to charge clients premium prices.

This is where technology, done right, can fix financial advice.

Technology can streamline administrative tasks, making account opening and routine client service a breeze. Tasks that take an hour today, should take less than 5 minutes.

Technology can automate the monitoring of client financial plans and investment accounts, providing true daily monitoring and flagging tax and fee-saving opportunities with ease, ultimately bettering the quality of advice and the outcomes for clients.

Technology can elevate the client experience, resulting in happier clients, better retention, and lower client acquisition time and expense.

Technology, done right, should dramatically lower costs and increase efficiency.

If a financial advisor can lower their costs by 50% and increase their efficiency by 500%, magic happens. Minimums go down dramatically, making professional financial advice more accessible. Fees drop, so client returns go up. Advisors can spend their time advising.

|

Current Financial Advisor Business |

|

|

Max clients |

150 |

|

Average client assets |

$300,000 |

|

Average fee % |

0.95% |

|

Annual revenue |

$427,500 |

|

Software costs |

$45,000 |

In action, it looks like this:

A financial advisor today might be limited to 150 clients. Assuming they work 2,000 hours per year (50 weeks x 40 hours/week) that’s 13.3 hours for every client. Except, it doesn’t work that way at all. The advisor often has to spend 10% or more of their time marketing new clients, another 10% managing their staff, 10% doing research on markets and vendors, a week or more attending conferences and training, and countless hours doing all of the other little things it takes to manage a small business.

Over half of the advisor’s time is spent doing things other than client-related work.

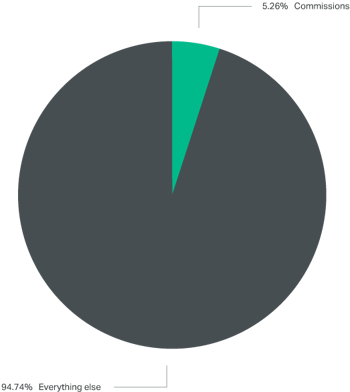

To make matters worse, advisors need a lot of vendors to make their business run. Software for financial planning, trading, billing, performance reporting, and more. The specialized software needed is fragmented and expensive, often priced on a per-account basis, so every client account no matter the size incurs a fixed expense. For an average advisory firm, the software costs typically add up to $300 per client ($45,000 for 150 clients), or more.

How software costs effect financial advice

It’s an economic disaster to offer low prices and/or help people who aren’t already rich. Advisors are left with no choice but to either run an operationally deficient business or just turn away people who need their help but don’t have enough money.

Increasing efficiency has a profound effect. An advisor paying almost nothing for software, and increasing their capacity by just double, can in effect charge less (if they want to), help twice as many people, work fewer total hours, and still earn more than they do currently. Client service and happiness go up, as does retention and referrals.

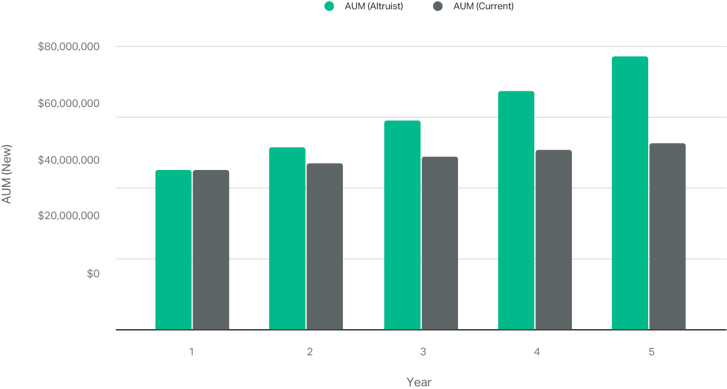

In the chart below we can see the possibilities for financial advisors to help more people by scaling their business and services. Instead of being limited to a small number of clients, advisors can serve a far greater audience, while simultaneously reducing software costs. This compound effect makes it much easier to serve clients of all wealth levels, as well as gives the ability to charge less (if wanted or needed).

How efficiency grows financial firms

The financial advisor of the future.

With less friction in running a small business, more than just the clients win. Advisors win too.

If we want to really make financial advice better, eliminating commissions is a nice start. But to make a seminal difference, we need to actually make financial advice better, more accessible, and more affordable.

This is why we built Altruist.