Continuing our series, Going Independent, we want to provide those considering going out on their own with an easy-to-follow RIA startup checklist of everything you need to do to form your own RIA.

Be sure to read part 1 of the Going Independent series: A series dedicated to starting your own RIA. Additionally, if you want to learn more about everything from start to finish to launch an RIA, we invite you to download our comprehensive RIA launch kit.

Key takeaways from this article:

- RIAs rely on a web of services and technology to launch their RIA and deliver an exceptional experience to clients.

- The best way to consider the key components of starting your own RIA is to bucket them as follows: Legal, Compliance, Finance, Tech Stack, Administrative Functions, and Marketing.

- Altruist consolidates most of your tech stack at an approximately 90% lower price point.

Legal requirements for RIAs

- Risk: Understand what’s at stake. Do you have a non-compete agreement signed with your employer? Are you being methodical about how you structure, engage and eventually disclose your new venture? Do your homework by carefully reviewing your existing agreements and consult an attorney if you’re unsure about anything.

- Entity: Establish a legal entity (most common is an LLC as it balances affordability, ease of establishment, limited ongoing obligations, and liability mitigation well). If it is within your budget, we recommend hiring a lawyer to help with this, but if that is not possible, check out LegalZoom and Rocket Lawyer.

- Agreements: An investment management agreement (also known as a client agreement or advisory agreement) is required. A compliance consultant or attorney can help create one. This should be inexpensive as these are highly commoditized and rarely vary between advisors.

- Intellectual Property: Protect what’s yours, and file for any trademarks that might reflect unique value propositions for your practice.

Setting up compliance for your RIA

- Get help: Hire a consultant. Navigating State and Federal securities regulations on your own can be overwhelming. With the proper support, you’ll receive the guidance your need to get what you need the right way. Learn more about how to hire the right compliance consultant.

- Get registered: Form ADV Part 1, 2, and 3 are required. A compliance consultant not only helps you with registrations, but they can also help with policies. These include information about who controls the firm, the type of business you’ll manage, fees, investment strategies, brokerage arrangements, and a summary of your business. Generally, you only file with your state securities regulator if you manage less than $100 million. If you manage more than $100 million, you are eligible to file with the SEC, and if you manage over $110 million, you must file with the SEC.

- Get licensed: You’ll need a Series 65 to practice as an investment advisor. This requirement can be waived in some states if you hold designations such as the CFP, CFA, or others.

- Pick a CCO: Someone must be responsible for developing and enforcing your policies and procedures. There are pros and cons to outsourcing this versus keeping it in-house, and I discuss this further in everything you need to know to set up your RIA compliance program. A compliance consultant can also play this role early on too if needed.

- Create policies: You’ll need a compliance manual, code of ethics, and potentially more policies and procedures depending on the clients you’re servicing, the securities you’re trading, and your portfolio strategies. It’s imperative to rely on help when creating these, as the requirements are voluminous and nuanced.

- Learn your policies: It's not wise to simply check the boxes of your regulatory requirements. Take the time to learn your policies and how they help fulfill your fiduciary obligations. You'll thank yourself when you're going through your first regulatory examination.

Finance

- Accounting: Keeping track of your general ledger and balance sheet should be the last thing on your mind. Establish a QuickBooks account, link to your banking account, set up your expense categories, and automate the process.

- Banking: Once you obtain an EIN from your Secretary of State, you can create a business banking account at your bank of choice.

- Credit: Take advantage of rewards programs and spend on credit cards that earn you 1-3% cash back. A simple Google search will always reveal the best programs at any time.

- Fees: Consider your long-term goals and the type of practice you want to run, and create your fee schedules for financial planning and advising on assets under management.

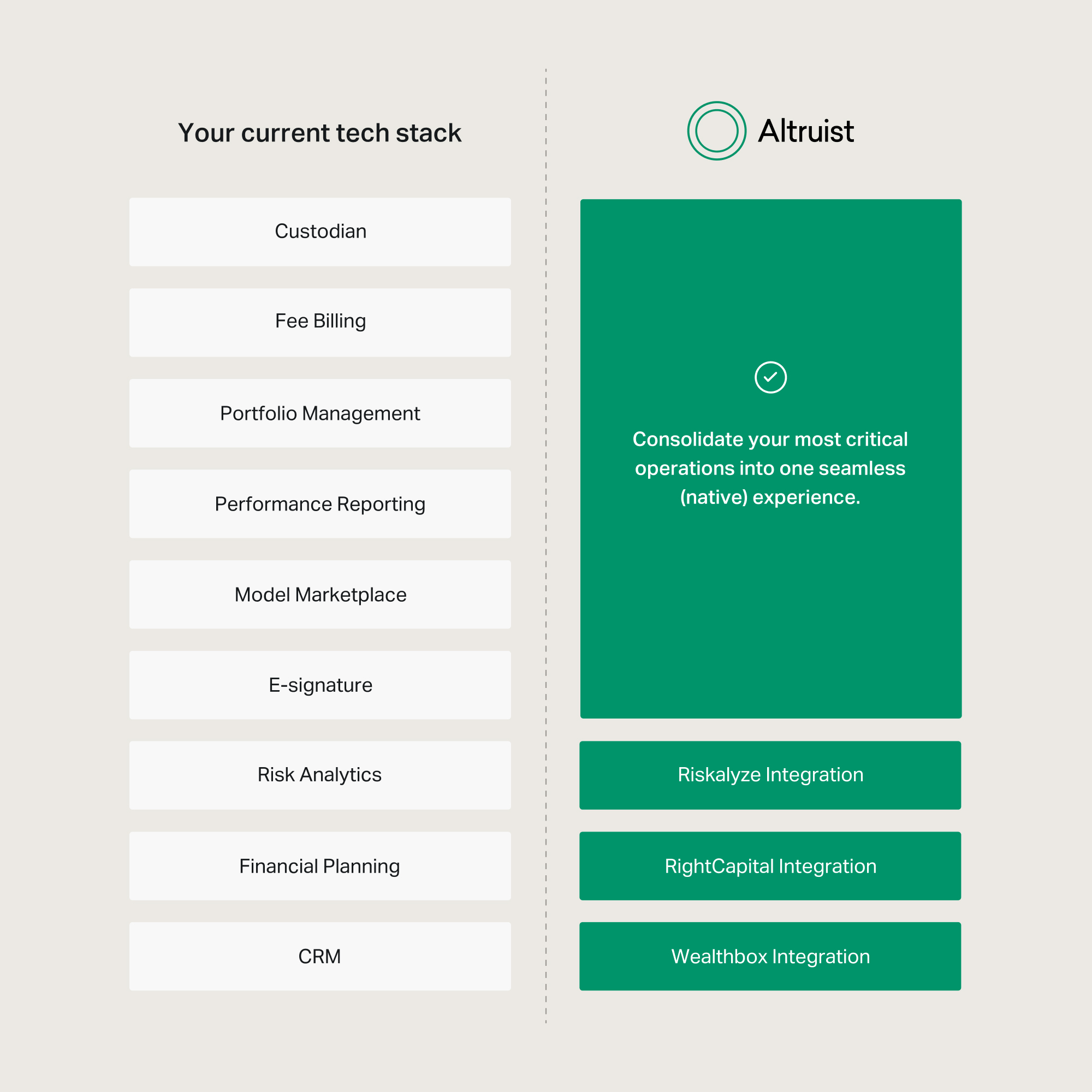

Simplify your tech stack with Altruist

Advisors get a best-in-class software tech stack in a fully integrated platform. Commission-free trading, performance reporting, automatic trade rebalancing, portfolio management tools, e-signature, fee billing, and an elegant client portal allow advisors to keep everything they earn.

Full transparency, we don’t currently have proprietary offers for financial planning, CRM, or risk analysis, but we have robust integrations with RightCapital, WealthBox, and Riskalyze.

The cost of software is no longer a factor in determining whether to form an RIA. If you’d like to see Altruist in action, you can book a demo by visiting altruist.com/breakaway.

The independent advisor tech stack

In case Altruist is not the right fit for you at this time (it happens), here’s a detailed list of why you need each technology for your RIA:

- Custodian: Find a brokerage to take custody of your client's assets and provide trade execution and settlement services. Some are commission-free, some aren’t, and the technical limitations with most leave you wanting more.

- Performance reporting: Be sure to select a vendor that integrates with your custodian to show how an account has performed over a period of time.

- Fee billing: Find a software provider that calculates fees you’ll assess on your client accounts and allows you to capture those fees without subjecting yourself to the SEC’s Custody Rule.

- Client portal: Clients need a way to access their accounts, transfer funds, authorize ACATs, and view their holdings.

- Trading program: Without an integrated solution, you need a way to identify client holdings, reconcile them with your portfolio strategies and rebalance them accordingly.

- Risk analysis program: Find a provider that shows you risk metrics, exposure, and intelligent ways to create the same expected return while minimizing expenses. We recommend Riskalyze.

- CRM: While also a highly commoditized service, a quality CRM is crucial to managing an efficient practice. Firms like Wealthbox build specifically for financial advisors, so you’re more likely to get the most out of your subscription fee than Salesforce.

- Document retention / archiving: RIAs are legally required to retain certain books and records. Your compliance consultant will identify these and (hopefully) recommend a provider like Smarsh, Global Relay, or Box to keep different records.

- Financial planning tool: If you’re proficient, a simple tool like Google Sheets or Excel can serve as your primary planning workhouse. If your skills are lacking, several software vendors can help. A vendor like RightCapital provides cash flow analysis, long-term planning, Social Security optimization, and tax-efficient strategies.

Perfecting your tech stack can drastically increase your RIA’s success, so make sure you thoroughly choose the best tools for your firm.

Administrative Functions

- Office space: Find somewhere to run your practice. And whatever you do, don’t fall into the trap of “I must project success and spend a lot on a fancy office.” People respond best to authenticity; no client likes to see their fees spent on expensive artwork, furniture, or high-rise views. Keep it sensible and respectable.

- Insurance: Purchase a reasonable health insurance policy for yourself (and any employees you might have), and be sure to obtain sufficient Errors and Omissions policy coverage.

Marketing for RIAs

- Brand & Design: While this starts with a name and a logo, you’ll want to consider how you present your firm carefully. What’s your value proposition, and how is it reflected in how you present and talk about your practice? Who's your ideal client, and what motivates them? Figure out these basics before hiring anyone to work on your image. And don't skimp with your brand – this is the foundation of your business, and budget solutions won't provide the level of quality and care your company deserves.

- Website: Setting up a website is a highly commoditized business these days. Squarespace, and other services like them, can get you up and running in hours. If it fits within your startup budget, it's always a good idea to hire a professional to help build out your content, including a strong copywriter to vocalize your brand story to connect better with your target audience.

- Email: Gmail for Business is easy and inexpensive. Unless you have a preferred email provider, stick with Gmail.

- Strategy: Put pen to paper and articulate your approach to servicing and acquiring new customers. Do you need a social media presence? Do you need an email communications tool? What type of channels do you use to find new clients? There’s no shortage of marketing consultants for RIAs that will promise the world to answer these questions. Some can be super helpful in guiding you, but you’ve probably already been successful in building your business. Hence, it’s best to start by thinking critically about what made you successful and how you can repeat that process.

Brand & Design: While this starts with a name and a logo, you’ll want to consider how you present your firm carefully. What’s your value proposition, and how is it reflected in how you present and talk about your practice? Who's your ideal client, and what motivates them? Figure out these basics before hiring anyone to work on your image. And don't skimp with your brand – this is the foundation of your business, and budget solutions won't provide the level of quality and care your company deserves.

Conclusion

We hope this serves as a useful high-level RIA startup checklist of everything needed when starting your own RIA. As always, our team is always happy to connect with you. Schedule a call now.

And in case you missed it, be sure to catch up on the previous articles in the series

- Going Independent: A series dedicated to starting your own RIA

- Going Independent: A guided checklist to forming your own RIA

- Going Independent: Choosing the best custodian for your RIA

- Going Independent: Let's get back to the (business) basics

- Going Independent: 6 mistakes advisors make on their Form ADV

- Going Independent: Registering your RIA with your state (or SEC)

- Going Independent: What does it cost to start your own RIA?

- Going Independent: How to transition clients to your new firm