Unified managed accounts, or UMAs, allow advisors to use multiple investment strategies as building blocks for an individual portfolio or client account. With UMAs, advisors can harness the best investment strategies across asset classes and managers, customizing them to meet individual client needs.

Unified Managed Accounts expand what's possible in portfolio construction

Portfolio reporting helps advisors visualize a client's portfolio over time, providing an easy way to showcase performance and possible outcomes.

Without it, advisors will spend hours manually analyzing data. Save time and energy and add it to your tech stack to free up time and focus on serving clients best.

Alongside individual securities and funds, standalone investment strategies can also be combined into a single account. This enables advisors to assemble “best of breed” portfolios by selecting managers with specific expertise across asset classes or investment styles.

For example, an advisor might use a US single stock model from one manager, add a foreign stock model from a second manager, and add bond exposure from a manager specializing in fixed income. Or an advisor might break an equity allocation into a core equity ETF model and augment with a dividend focused individual stock model.

Similarly, UMAs are a powerful tool for developing core-satellite investment strategies. Automated rebalancing at the strategy level helps keep risk in check and track target allocations.

Deeper personalization with advisor-built models

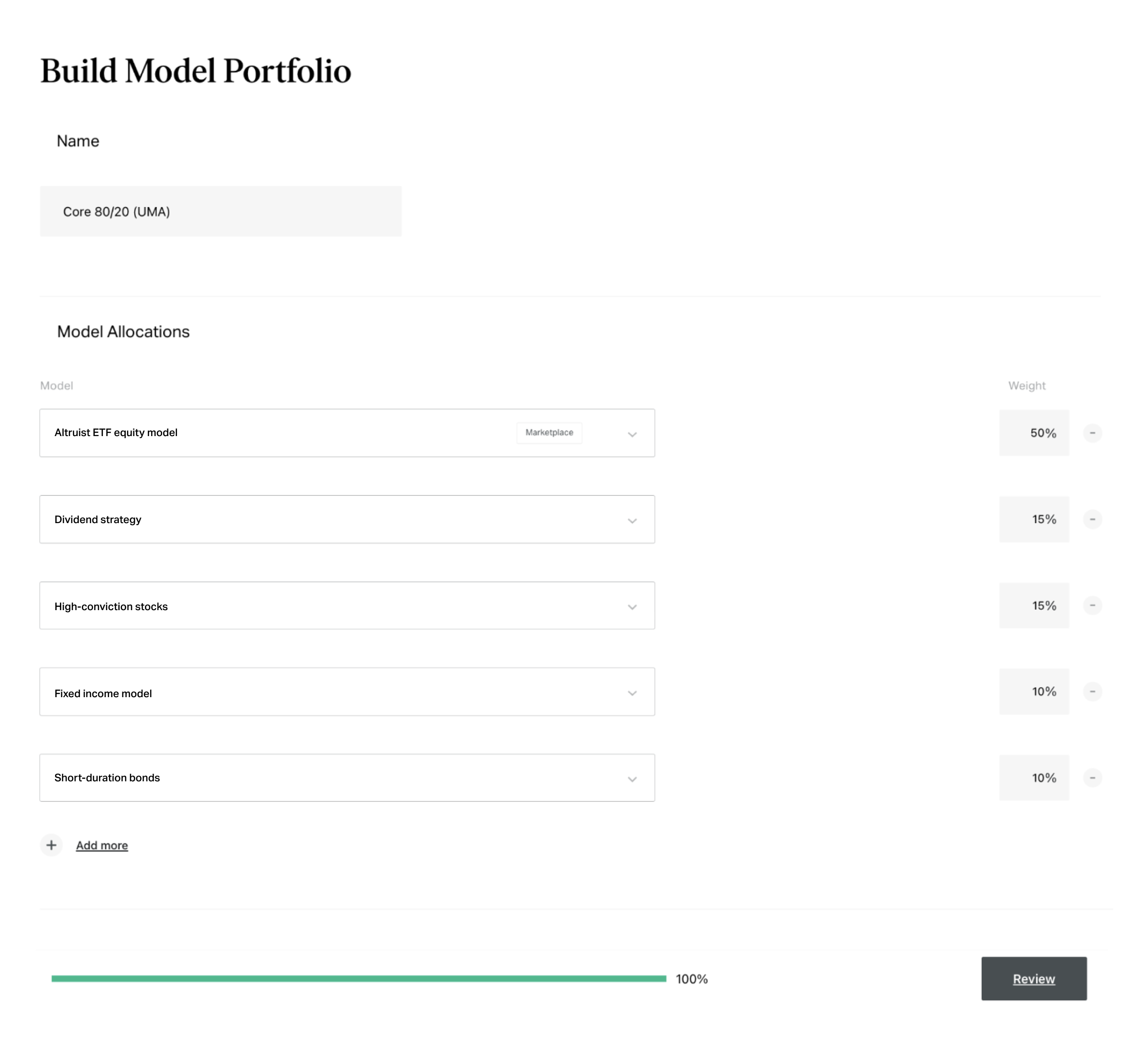

UMA capabilities at Altruist don’t stop with third-party models. Advisors can add their own custom models into the portfolio in conjunction with third-party models. For example, an advisor might have a core equity model from a top manager and add in their own high conviction stock model.

Mixing in advisor-generated models allows for pinpoint customization of a portfolio that uses third-party strategies. For example, an advisor may like a third-party strategy, but wishes to tilt more towards US equities. In this case, the advisor can add an additional sleeve of US-focused securities to achieve the desired regional exposure.

Incorporate the benefits of direct indexing inside Unified Managed Accounts

Models holding individual stocks can offer a suite of advantages, including more opportunities for tax loss harvesting, transparency and customization, and lower costs compared to funds. UMA functionality empowers advisors to easily employ the advantages of stock-based models.

One popular strategy is direct indexing, where the model seeks to track an underlying index by holding its individual securities. Altruist currently offers a direct index model that tracks the 500 largest stocks in the US by market capitalization and can be added to UMAs for US large cap exposure.

Lower cost and no minimums

Historically, Unified Managed Accounts have only been available to higher account balances. With Altruist’s fractional share capability, accounts at virtually any balance have access to UMA capabilities. And unlike other RIA platforms, you only pay for what you use – model-specific fees are prorated to the percentage of the model used within the custom portfolio.

With the launch of UMAs, Altruist is making it easier for advisors to assemble portfolios that better address the unique needs of their clients.

Altruist LLC and its affiliates (together, “Altruist”) and the Model Marketplace model providers do not render investment advice to retail clients, rather Altruist makes available certain model portfolios for independent RIAs’ use in managing their retail investment clients’ assets. RIAs are responsible for suitability of all transactions in and decisions regarding client accounts, and must maintain trading authority over client accounts which are subscribed to Model Marketplace model portfolios.

Certain instructions from model providers who are providing models to the Altruist Model Marketplace may not be executed based on system limitations, including securities that are not available to trade on the Altruist platform and rebalancing instructions that are not supported by the Rebalancer and trades that are below supported minimum trade sizes. Performance of individual accounts assigned to a model portfolio may deviate from the target model performance as a result of a number of factors, including Rebalancer settings, and timing and amount of cash flows and system limitations that impact execution of model provider instructions. Model Marketplace portfolios utilize Altruist’s Rebalancer and may use Altruist’s TaxIQ tax management tools. See the TaxIQ Tools & Rebalancer disclosure available at altruist.com/legal.

For more information on Altruist’s Model Marketplace please see the Form ADV Part 2A, Model Marketplace Agreement and Altruist LLC Fee Schedule on altruist.com/legal.