Maybe you have been told that it costs a lot to start an RIA. However, the person telling you that, have they actually started their own RIA? Or are they sharing inflated ballpark numbers because they really don’t know?

Rather than take someone’s word for it, in this installment of the Going Independent series, we'll lay out what it could potentially cost, so you can see if going independent is right for you.

Disclaimer before we dive in: The figures here are ball-parked — your situation is unique, and the costs will reflect that. We’ve cited every price point in the appendix for folks to review our high/low-end sources. When we make assumptions, we will deliberately call them out. This is intended to demonstrate a point directionally, not specifically.

The information we’ve gathered makes it clear that the economics of breaking away is pretty compelling – especially if you intend to be in the business of independent financial advice for the next 10 years.

Key Takeaways from this article

- Your startup expenses will vary at the individual line item level, but the major factors that can drive up costs are whether you decide to get office space and/or hire an employee in your first year.

- With Altruist, you can drastically reduce your tech stack spend, consolidating most RIA software expenses.

- We’ll explore 3 scenarios that demonstrate how an RIA’s higher payout rate can give you flexibility for growth and lifestyle choices despite the (1) additional startup/ ongoing costs and (2) the missed opportunity of a lock-up bonus.

Broadly speaking, there are 5 categories we can use for startup expenses

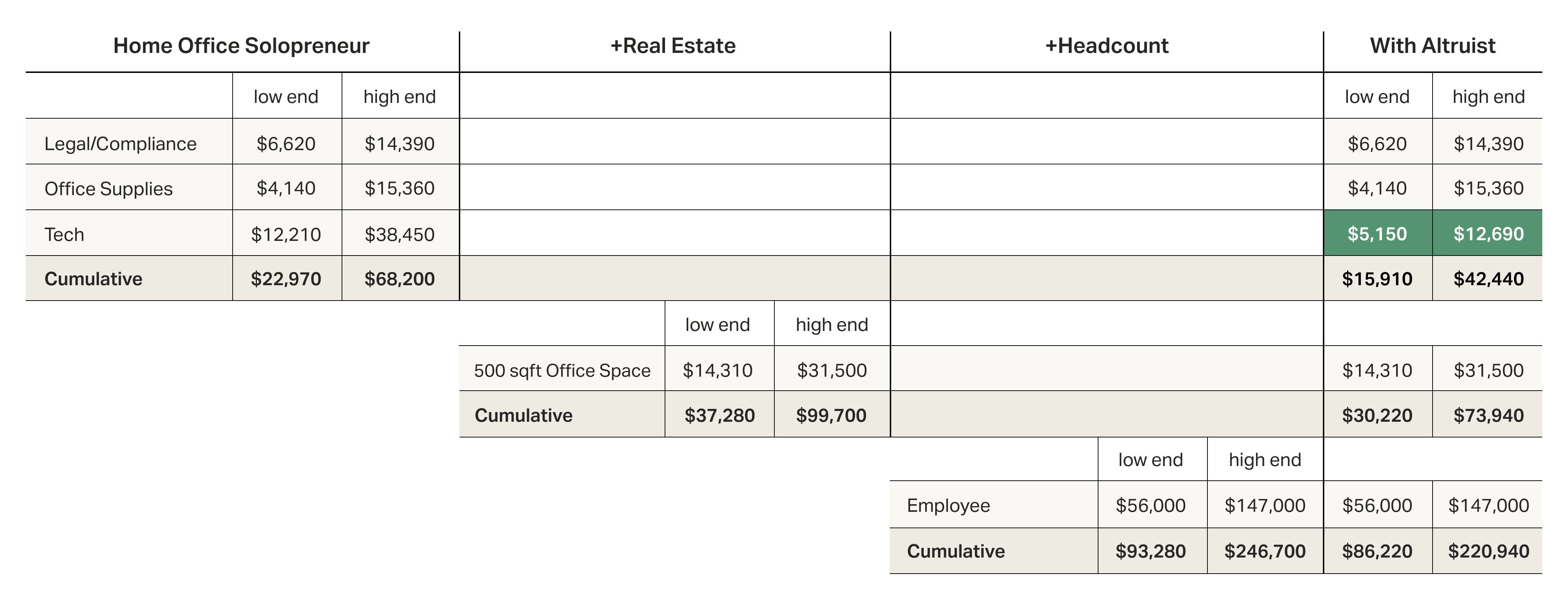

Including your tech stack, legal & compliance, office supplies, real estate, and headcount. The chart below hypothetically breaks out the category and cumulative pricing in a waterfall from left to right.

On the far right-hand side of the chart, we’ve calculated Altruist’s impact on the RIA tech stack portion of potential startup costs. Altruist consolidates fee billing, performance reporting, your client portal, trading, and rebalancing; the first 100 accounts are free, and every account after is $1 per month. The average advisor on our platform has less than 100 accounts and thus is not paying anything for the technology (keep in mind that other brokerage service fees may apply on your client's assets, and those details can be found on our Legal page).

On the far right-hand side of the chart, we’ve calculated Altruist’s impact on the RIA tech stack portion of potential startup costs. Altruist consolidates fee billing, performance reporting, your client portal, trading, and rebalancing; the first 100 accounts are free, and every account after is $1 per month. The average advisor on our platform has less than 100 accounts and thus is not paying anything for the technology (keep in mind that other brokerage service fees may apply on your client's assets, and those details can be found on our Legal page).

What about ongoing costs?

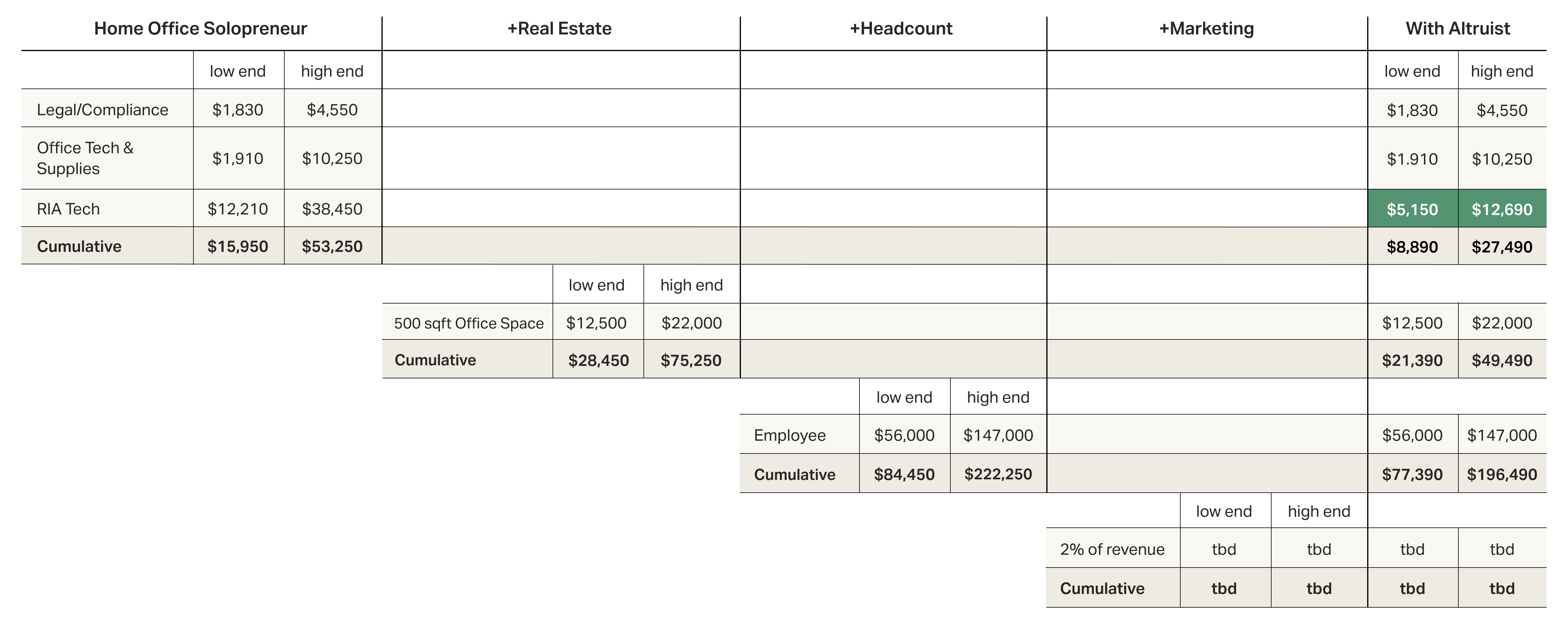

After the first year, reduced or eliminated expenses across legal, compliance, office furniture/decor, and office supplies with a multi-year lifespan, the chart will look something like this (note the addition of marketing expenses).

A note on marketing expenses

A note on marketing expenses

Marketing expenses will fluctuate depending on what your goals are. Maybe you’re putting on an event one quarter and sending out direct mailers the next. Or you’re investing in marketing tech, etc. You might also get some “free” growth via referrals. Needless to say, there’s a lot of variability in the “marketing” category to build that into our model. So for the sake of simplicity, we’re assuming the average independent advisor spends 2% of revenue on hard-dollar marketing expenses (per Kitces).

Comparing Business Models

At a broker-dealer or wirehouse, you don’t pay for tech, real estate, office supplies, legal, or compliance — well, in a sense, you are in the form of a less-than-100% payout rate.

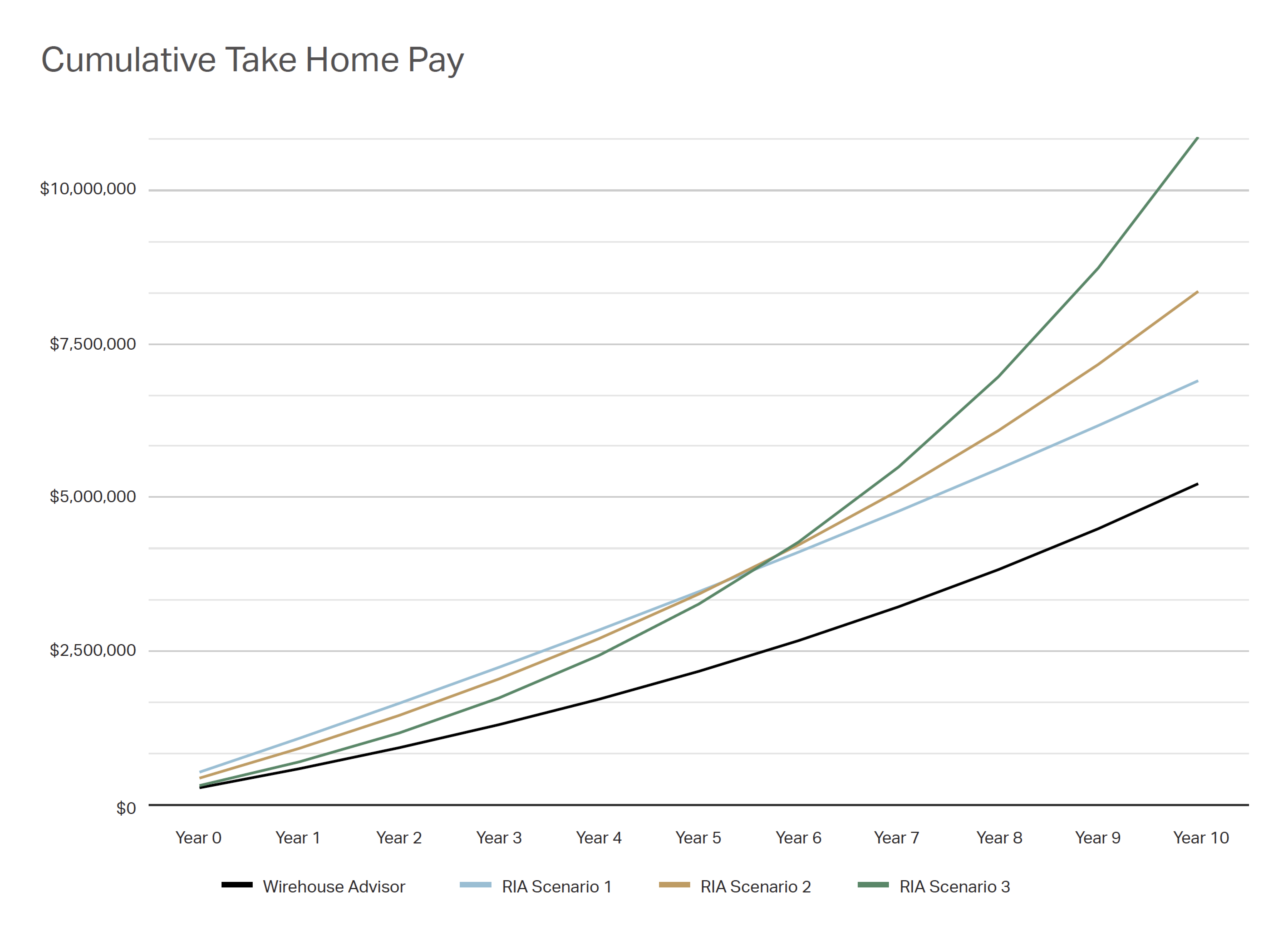

In this section, we’ll compare a wirehouse advisor’s cumulative take-home pay over a 10-year period vs. an RIA. Again, we’ve made some assumptions here to build an oversimplified model to make a directional point — your numbers will be different.

Those assumptions are:

- The advisor at the wirehouse

- has a payout rate of 47%

- has a tax rate of 40%

- manages $100m

- has a compound annual growth rate of 10%

- The RIA

- is using Altruist

- has a payout rate of 100% (before business expenses)

- has a tax rate of 40%

- has a first-year startup cost of $52k and ongoing costs of $35k (taking an average of low and high end for an advisor who is paying for office space but has no employees)

And the areas we’ve oversimplified are:

- We applied an across-the-board 40% tax rate on all revenue (in the RIA’s case, revenue after expenses)

- We have not included additional brokerage fees in the take home payout calculation

- We are assuming a consistent CAGR

- We are not adding headcount alongside growth

Three scenarios

Scenario 1

Let’s assume the RIA has a similar sized book of business ($95m), but is pursuing a less ambitious growth rate (3%) by only allocating 0.5% of revenue towards marketing. By year 10, this advisor will have taken home more than $1.6M in cumulative pay.

Scenario 2

Let’s assume the RIA has a more niche book of business ($80m), and a comparable growth rate (10%) and is using the average 2% of revenue as a marketing budget. By year 10, this advisor will have taken home more than $3.1M in cumulative pay.

Scenario 3

Let’s assume the RIA has an extremely niche book of business ($60m vs $100m), which is enabling him or her to achieve a higher growth rate (20%), and to maintain this growth, they are increasing their marketing spend to 3% of revenue. By year 10, this advisor will have taken home more than $5.6M in cumulative pay.

And there’s also the equity to consider

And there’s also the equity to consider

The cumulative take-home pay calculations are just one piece of the puzzle — you’re also building equity in a business. According to M&A consultancy Advisor Growth Strategies, the 2022 median adjusted EBITDA multiple for RIAs was just under 9x! These two factors (in addition to more strategic control and better quality of life) may have something to do with why 4 out of 5 advisors who launch their own RIAs are happier for it.

When you’re ready to launch, we’re here for you

At Altruist, we strive to make independent financial advice better, more accessible, and more affordable. Our custody solution gives back precious time and capital to RIAs, so you can focus on what matters most: your clients and business.

On one intuitive, integrated platform, advisors can open and fund accounts, trade and rebalance, report, and bill, at a fraction of today’s edging-ever-higher technology costs.

For new firms, existing firms, and advisors planning to make the leap from their wirehouse —the grass really is greener— our dedicated customer support team ensures a smooth transition and exceptional ongoing service.

To see how we’re helping RIAs streamline operations, reduce overhead, and elevate the client experience, book a call with one of our advisor advocates today.

True independence awaits. Talk with one of our experts today.

In case you missed it, be sure to check out the other articles in our Going Independent series:

- Going Independent: A series dedicated to starting your own RIA

- Going Independent: A guided checklist to forming your own RIA

- Going Independent: Choosing the best custodian for your RIA

- Going Independent: Let's get back to the (business) basics

- Going Independent: 6 mistakes advisors make on their Form ADV

- Going Independent: Registering your RIA with your state (or SEC)

- Going Independent: What does it cost to start your own RIA?

- Going Independent: How to transition clients to your new firm