This is why it costs too much to give good financial advice.

Mazi Bahadori is the CCO and VP of Securities at Altruist. He’s responsible for ensuring everything we do is in the best interest of our clients.

Imagine you’re a financial advisor with 200 clients and $100 million under management. You charge a flat fee of 1% to manage your client’s assets. You avoid commission-based transactions because you’re a fiduciary. You want your clients to succeed.

You may be thinking in that example some simple math shows you’re making $1 million a year and doing great! Exciting, isn’t it?

Think again.

It costs a lot to run your business. This cost depends on whether you’re part of a large organization or on your own. It depends on your team size. It depends on the geographic reach of your clients. It depends on the complexity of the financial planning and investment strategies used.

But most importantly, it depends on how you use technology.

For some advisors, that last point is moot. If you’re at Bank of America, Morgan Stanley or Wells Fargo, you don’t have many options. Each of those firms will take between 55% to 70% of the fees you earn and will give you little flexibility in choosing your software.

And contrary to what many might think, their software is – as politely as we can put it – not that great. They’re built on archaic systems with decades-old code and it takes them years to roll out a simple new feature.

Just google “Morgan Stanley COBOL developers” (a 1950’s programming language for those who don’t geek out on technology). It’s frightening how in demand it is.

So, if it doesn't sound very appealing to generate $1 million of revenue only to keep a few hundred thousand of it before taxes (while using antiquated software) – your next best option is to go out on your own as an independent advisor.

What an RIA needs

To do so, you become a Registered Investment Advisor. You’ve hung up your own shingle, and you’re open for business. But with no Morgan or Merrill backing you, you have to pay for every piece of software you need. Not to mention you’ll need office space, insurance, someone to help you navigate the SEC’s rules and regulations, and so on.

Because leasing an office varies dramatically depending on which city you’re in, we’ll leave that out. And for things like insurance, compliance, and HR, most of that is highly commoditized these days, so there’s plenty of help for advisors at semi-reasonable costs. But with core software for RIAs, it’s still the wild west.

While not exhaustive of everything an advisor could use, here are the seven critical things most every advisor needs:

-

A custodial partner (a company that will actually hold your customer’s cash and investments)

-

A way to onboard customers (moving someone from potential customer to a client without violating federal or state law)

-

Portfolio accounting system (keeping track of how much money each customer has, collect fees, etc.)

-

Portfolio management (to manage money with the expectation of a return)

-

Risk/tax optimization (to manage money while considering appropriate risk and tax strategies)

-

Customer Relationship Management software (to keep track of your clients, how often you speak with them, etc.)

-

A portal for the advisor and client (so your client can see what’s up with their money)

There are a few ways to tackle this:

- Different software for each

- One custodian + a single provider for everything else

- Fully integrated solution

1. Different vendors

The benefit of this approach is that it’s the most customizable option, allowing you to pick the best solution for each. But there are three problems with this solution...

First, your custodial options, while plentiful, are limited in their differences. Most all of them still charge you $7 to trade stocks and ETFs or $40 for mutual funds. These are costs the advisor bears, but often get passed on to clients, and their returns suffer as a result.

Second, this can get expensive, and fast. Selecting the best vendors likely means paying for the best, and with no aggregate solution you can easily shell out $50k per year in software licensing fees.

Third, you’ll spend all day switching between windows. Your CRM won’t be integrated with your portfolio accounting software which won’t be integrated with your on-boarding software. Imagine prepping for an annual portfolio review meeting. It’ll take hours just to get the basics on paper.

2. Single custodian plus single provider

You still have the challenge of the typical custodial partner. But at least now you have a single software vendor attempting to consolidate every other core function. Your cost, while better than the customizable option, is still steep, and likely closer to $25-$40k per year.

And unfortunately, your ability to use the software will only be as good as your custodial partner’s ability to integrate – which, as any advisor could attest, is challenging at best.

3. Fully integrated approach

A fully integrated platform that does everything. One vendor to work with. One window to keep open on your computer. One fee to pay. This seems ideal, right? Not with today’s options.

The problem here is the cost. Most fully integrated providers will charge between 10 to 25 basis points, meaning you’ll pay $100-250k per year to use their platform and services in our example. And if you’re not paying a flat fee as part of a wrap fee program, they’re likely nickel and diming the advisor, who has to pass on the cost to her clients.

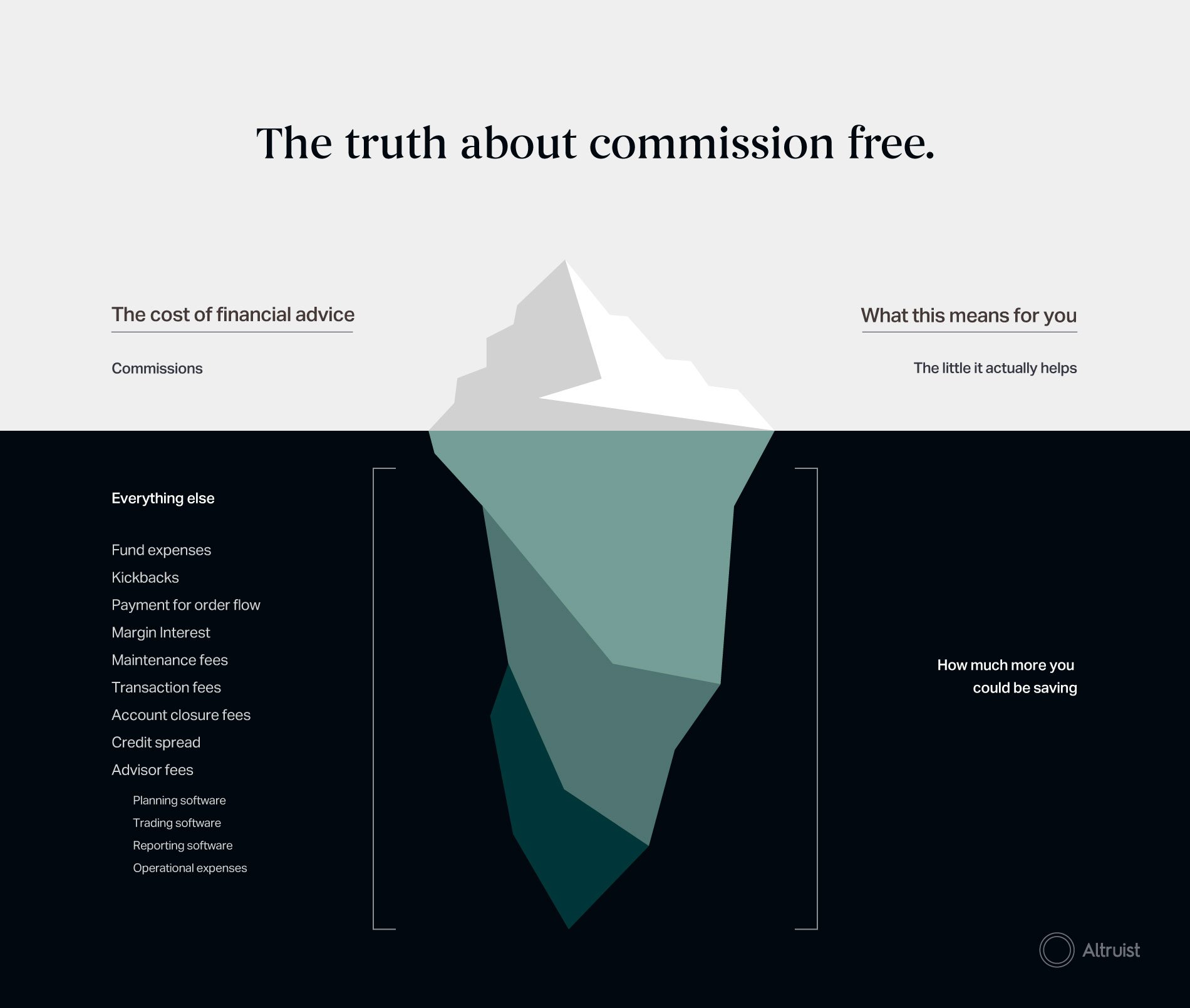

For fiduciary advisors, this can be a nightmare, with the provider making multiples of the costs they’re claiming they charge (e.g. just ask them about securities lending, money market spreads, etc.). But if you’re just earning a commission and not required to put the client’s interest first, this option isn’t too bad since every cost is a passthrough so you don’t need to care as much about the outcome.

What’s the best option?

Let’s go back to our hypothetical (remember, you’re an advisor with 200 clients and $100 million under management). Now imagine you have an integrated brokerage platform designed by and for fiduciary financial advisors. No commissions. No software fees. No biases.

Remember that $1 million in fees you’re generating? Imagine you get to keep it. All of it. And you have great technology that will do everything for you.

Best of all, your clients will enjoy an incredible experience with no absurd passthrough fees, commissions or other charges. More of their money will be doing what it’s supposed to do – staying invested in the market, and not paying some software vendor’s fee.

Seems like the best option, doesn’t it? We certainly think so, because that’s exactly what we’re building. If you haven’t already joined our waitlist, sign up below to stay in the loop.