4.9%. That’s what investors could earn in annualized returns on a balanced portfolio over the next ten years.

This is the latest from Vanguard’s ten-year economic outlook for a 60/40 portfolio (60% stocks, 40% bonds). And it’s a far cry from the 7.3% return since 1990 and the 9.4% return since 1970. Investors hoping to have a chance at retirement will need to intelligently navigate the rough waters of the upcoming lost decade of returns.

Source: Vanguard

While 4.9% might not sound that bad with inflation hovering between 1.5-2%, there’s more than meets the eye with an investment portfolio.

Need for an advisor

First and foremost, investors that don’t work with a financial advisor are already leaving 3% in annualized returns on the table. 3%! If a client invested $100,000 thirty years ago, a difference of 3% in returns is $500,000 lost on a balanced portfolio.

Why? It’s simple. Fiduciary financial advisors save that 3% for their clients by doing things like properly allocating assets, regularly rebalancing portfolios, identifying cost-effective investment opportunities, preventing bad financial behavior, and enforcing disciplined spending strategies. But don’t take our word for it; check out the research.

Investors that think they can go it alone, keep their emotions in check, and screen the $100 trillion world of capital markets to find suitable tax-efficient investments are probably a bit out of their depth. Sane people wouldn’t trust themselves to diagnose a serious heart condition (unless they happen to be a cardiologist), so why should they go it alone when managing their financial livelihood?

Is the advisor doing enough?

But it doesn’t just stop with the advisor. Let’s assume a financial advisor is charging 1% to manage a client’s portfolio. That 4.9% annual return now becomes 3.9%. Factor inflation of about 2% and we’re down to 1.9%.

Unless the advisor is only ever buying individual stocks, the investor is likely paying 50-60 basis points (one basis point is 1/100 of a percent) in management fees and expenses for mutual funds. That figure could be 30-40 basis points if the advisor is using ETFs offered on their platform. Let’s call it a blended rate of 45 basis points, which puts the investor at 1.45%.

If the advisor only uses mutual funds, the investor could also pay 12b-1 fees (these are distribution-related fees that mutual fund companies pay to get their products listed on platforms that investors can purchase). Tack on another 25 basis points plus the transaction fees. But if the advisor is only using ETFs and stocks, the investor is also paying commissions every time there’s a buy and sell in the portfolio. That’s another 5-10 basis points. On average, these additional fees and charges will cost the investor another 15 basis points. Our investor is now earning 1.3% in annualized returns.

Let’s think about this number: 1.3%. Any investor can pick up a 10-year CD today with a guaranteed annual return of 3.1% at an FDIC insured bank. We still have inflation to consider, so that number drops to 1.1%.

1.3% in the markets versus 1.1% in a CD. That’s a paltry difference of 0.2%!

Is the emotional turmoil of markets, watching an investor’s money fall by 15% one year and jump up 20% the next worth earning an additional 0.2% over a ten year period? Maybe. For most people, however, it’s probably not.

What can we do?

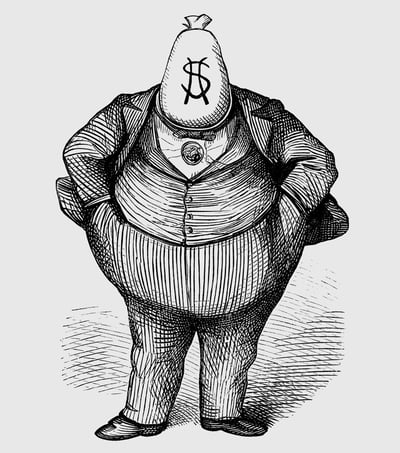

Friction is the enemy of sensible investing. Friction is what makes Wall Street rich. A few basis points here and a few commissions there charged to millions of investors are what generate billions of dollars in profit for the big firms.

Altruist has a different approach and it’s simple: get rid of the friction so investors can keep more of their money.

Commission-free trading and non-transaction fee mutual funds that save investors 15-30 basis points each year.

Software using artificial intelligence to automatically find the most cost-effective investment opportunities for any client’s risk-return expectations that save investors 45-60 basis points each year.

An elegant portfolio accounting system that will save advisors tens of thousands of dollars each year.

These savings add up, and over the course of a lost decade of returns, make investing far more appealing.

Eliminating friction is not about generating wealth. It’s about preventing waste. Why give Wall Street more of an investor’s hard-earned money? That’s why we’re building Altruist.