COVID-19 has dominated the headlines, and with so many updates being announced daily, it can be overwhelming to keep track of them all.

In the shuffle, you may have missed two important programs designed to help small businesses endure the unintended consequences of the pandemic: the Payment Protection Program and the Employer Social Security Tax Deferral plan.

Many RIAs haven’t heard of these programs, or may not know how they could help their business.

Both initiatives were signed into law under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The Payment Protection Program (PPP), implemented by the Small Business Administration, provides small businesses with funds to pay up to 8 weeks of payroll costs. Eligible recipients can have their loans forgiven, should they meet the requirements. The Employer Social Security Tax Deferral plan allows an employer to defer the employer’s share of social security tax that otherwise would be required to be deposited and paid in 2020.

If you’re a financial advisor with your own RIA, both programs sound great, especially if you have any staff supporting your business.

Unfortunately, the IRS only lets you pick one. If you accept PPP money and have the loan forgiven, you can’t defer social security taxes. This begs the question: which one should you pursue?

The Payment Protection Program Loans

The initial allocation of $349 billion ran dry less than three weeks after the program became law. However, as of the time of this writing, the White House and Congress are allocating an additional $310 million to the PPP. By all accounts, it looks like there should be another few weeks of money available – which means RIAs should get their loan applications in ASAP if they haven’t already.

These loans are provided by banks that are qualified SBA lenders. Your first port of call should be your current business bank as most banks require that you already have a business checking account to even permit you to fill out an application.

If you’re approved for a loan, you can receive up to 2.5 times the average monthly payroll costs over the previous year, capped at $10 million and excluding annual compensation in excess of $100,000. The loan is eligible for forgiveness if the loan proceeds are spent on payroll, rent, utilities or healthcare costs, and you do not reduce any employee headcount.

Social Security Tax Deferrals

If you do not have debt forgiven under the CARES Act, you are eligible to defer payroll taxes from March 27 through the end of the year. Half of the taxes otherwise due must be paid by December 31, 2021 and the remaining half paid December 31, 2022.

For self-employed RIAs, this applies to you, too (with respect to the employer equivalent portion). And half of your self-employment taxes can be deferred under the same schedule.

Comparing the two

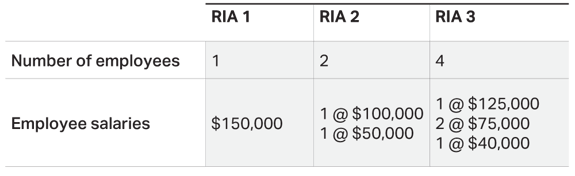

Let’s review a few scenarios of PPP compared to social security tax deferral:

Here’s what each RIA could potentially receive from a PPP loan:

Assuming you make no reductions in headcount, and you spend these loan proceeds on qualified expenses, you will be eligible for loan forgiveness. Keep in mind, you still need to make payments on these loans, though rates are capped at 4% and it’s likely payments can be deferred for 6 to 12 months (though more guidance is forthcoming from the SBA).

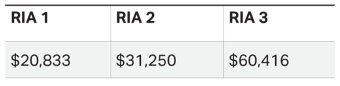

Let’s assume that you don’t think you’ll be able to retain your staff. In that case, your PPP loan would not be forgiven, so it may make the social security tax deferral more appealing. Here’s how much each RIA could potentially defer:

These taxes are still due, with half owed at the end of 2021 and the remainder at the end of 2022, thus resulting in a zero-interest loan for more than two and a half years.

Which option is best for you?

If you’re in a position to take advantage of the PPP loan, and you’re confident you won’t reduce your headcount or use the proceeds in a way that jeopardizes loan forgiveness, the PPP loan is most compelling.

However, if you don’t think you’ll satisfy all requirements of the PPP, the question becomes whether you want to take a smaller, zero-interest loan for 2.5+ years, or pursue a loan roughly 4 times larger (on average) with up to 4% interest. If you think riding out the storm is manageable without incurring any additional obligations, deferring social security tax payments is likely your best option.

Don’t forget there are a number of other programs and tax changes RIAs should be aware of, like the employee retention tax credit, net operating losses offsetting prior-year tax liabilities and student loan payment deferrals.

We’re not tax advisors and this is not meant to be tax advice. As always, please consult with your tax advisor or accountant before making any decisions.