A truly great financial advisor cares deeply about their clients.

They go out of their way to help them quantify what’s important to them about money, build plans to help them in that pursuit and work with them on an ongoing basis to stay on track. They offer their guidance without conflicts of interest and provide great service at a fair price.

Financial advice is pretty powerful when done right. Yet, most advisors don’t track client happiness, directly or indirectly. Financial advisor retention should be a goal you focus on as your firms scales and grows

With new rules proposed to allow client testimonials and the increasingly popular (and influential) review sites, advisors would be wise to better understand how their clients really feel about them. And, if they are happy, make it easy and rewarding for them to help others with their planning needs.

How clients find advisors as a financial advisor(and most things, really)

Like it or not, most people start their search for just about everything nowadays, online. Retail purchases dominate, with over 91% of purchases starting online. Real estate, automobiles, and home services professionals all exceed 80%.

For how to find clients as a financial advisor, 30% of people say they make all of their own financial decisions based on “Google”. Just 22% say they work with a financial professional.

For those who do work with an advisor, the path to getting there is pretty similar to those who choose to make money decisions for themselves.

38% of people say they choose their professional services provider via online research (a number that has quadrupled in the past 10 years) and 29% via referral from a friend or family member. According to Nielsen's Global Trust in Advertising Report, 83% of respondents said they trust recommendations from family and friends more than any other form of advertising. 91% of people regularly or occasionally read online reviews, and 84% trust online reviews as much as a personal recommendation. And, they make that decision quickly: 68% form an opinion after reading between one and six online reviews.

Think about that for a minute. Even if you do everything right - from your branding to your blog posts to your marketing efforts, one customer's bad experience with your brand could cost you your financial advisor client retention. In fact, customers are more likely to talk about a bad experience with your brand than a good one, and they tell almost 3 times as many people when it happens.

That’s a whole lot of stats that basically tell the same thing:

You need to know how to find clients as financial advisor and have happy clients, then you need to make it easy for them to share their happiness, especially digitally.

A simple way to measure client happiness

If you care about clients and do great work with exceptional service, you should have happy clients. But are you measuring your financial advisor client retention? What if you had just one upset client, and you didn’t even know? Is there something you could/should be doing better to find clients as a financial advisor?

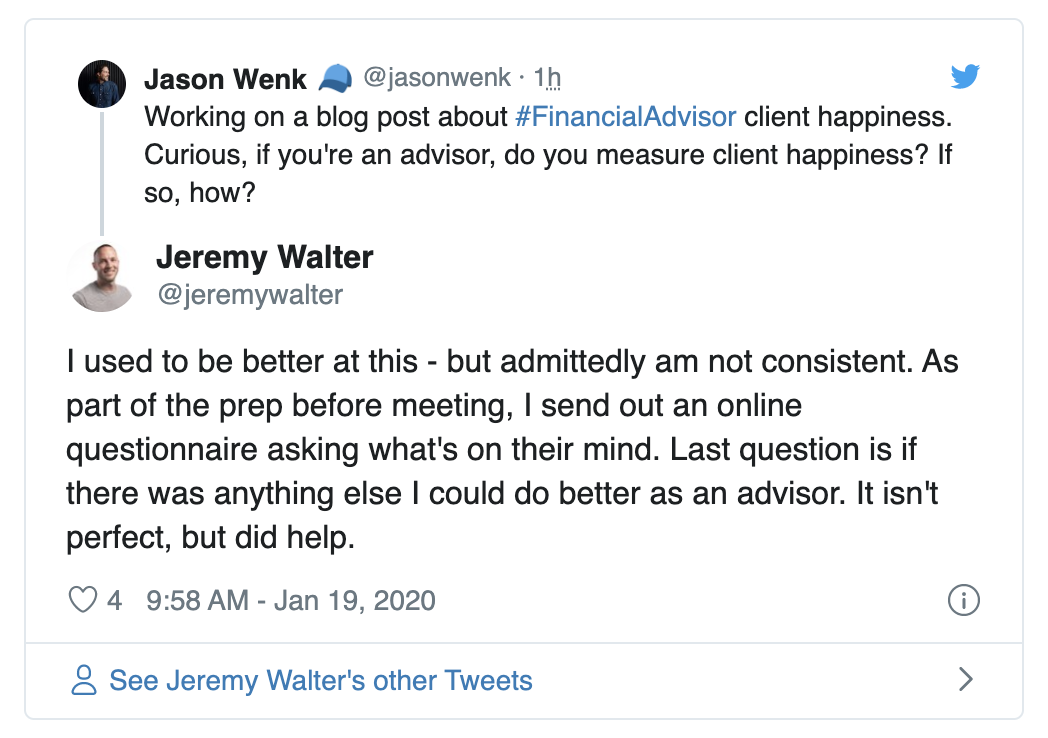

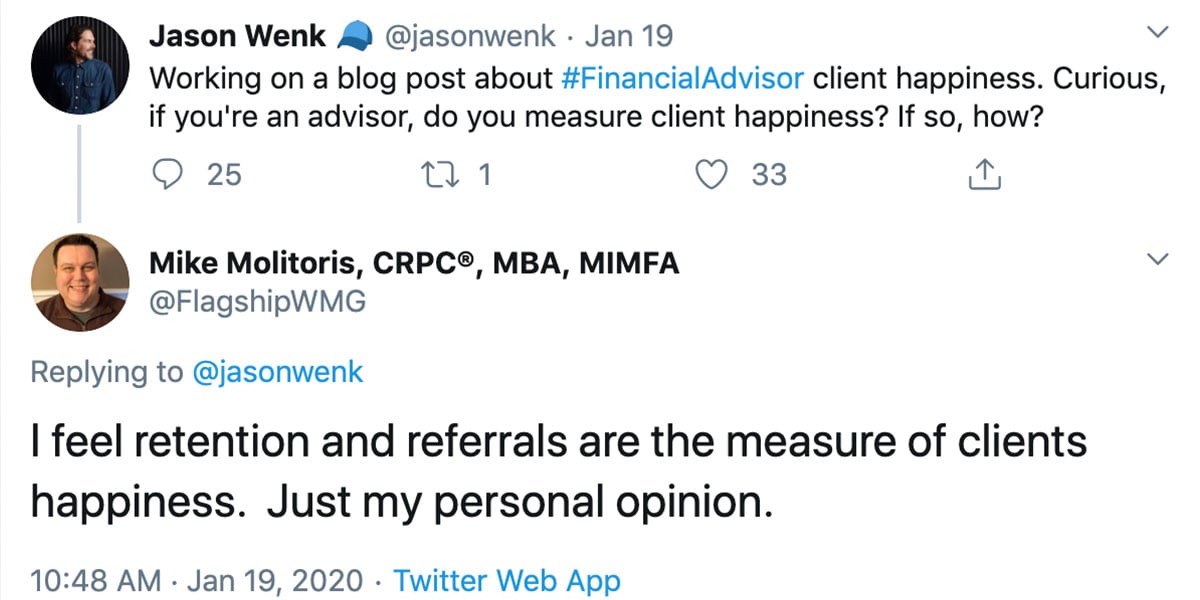

I wanted to take the pulse of the #FinTwit community (financial advisors on Twitter) about how they measure client happiness, and the results were interesting.

There were some that had a defined process, though admitted the shortcomings:

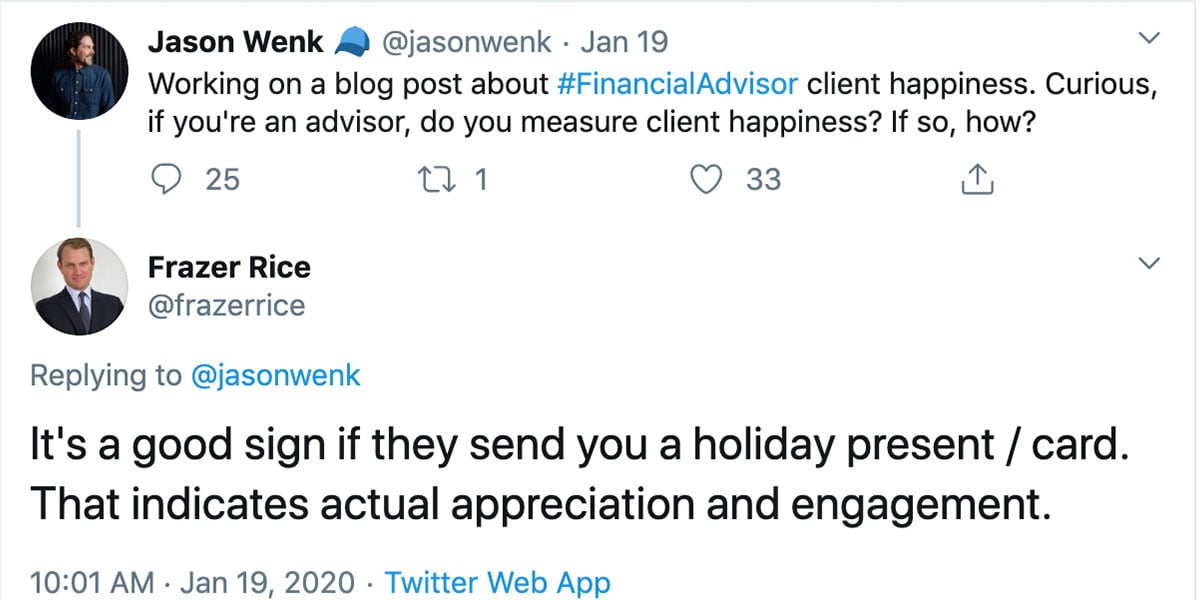

Some that weren’t scientific, but made sense in tracking financial advisor client retention:

To those that had some metrics, but I’m not convinced most advisors are actually tracking:

Today, with the help of social media, your clients can quickly share their experiences with their entire networks with just the press of a button. This makes collecting feedback and identifying headaches critical, not only to prevent bad client experiences and reviews but also to make them so happy that they recommend you to friends and family which is one of the best wins for financial advisor client retention.

A tool used by almost every significant software company (and meaningful businesses in general), is the NPS®, or Net Promoter Score. If you’re unfamiliar with NPS and how to best utilize it as a financial advisor, consider this your crash course.

What is NPS and why does it matter?

NPS stands for Net Promoter Score. It's a customer satisfaction benchmark that measures how likely your customers are to recommend your business to a friend.

NPS is a typical benchmark company's measure to evaluate and improve customer loyalty. NPS is different from other benchmarks, such as customer satisfaction score (CSAT) or customer effort score, in that it measures a customer's overall sentiment about a brand, versus their perception of a singular interaction or purchase. This makes it particularly useful for service professionals, like financial advisors, and can help you learn how to find clients as a financial advisor.

How do you calculate NPS, and what is a “good” number?

- Survey your clients and ask them, "On a scale of 0 to 10, how likely are you to recommend us to a friend?"

- Categorize respondents according to their score: Scores 0-6 are Detractors, scores 7-8 are Passives, and scores 9-10 are Promoters.

- Disregarding the Passives, subtract the percentage of Detractor responses from the percentage of Promoter responses to determine your Net Promoter Score. This score can range from -100 to 100

As the names suggest, promoters are enthusiastic, loyal customers who will tell their friends about you or your firm and help bring in new clients as a by-product of your current financial advisor client retention. Passives are indifferent, they aren’t raving fans but also aren’t unhappy. A client who stays with you but never refers could fall into this category, and typically are open to leaving you if they found an option they felt was better. Detractors are unhappy customers, and not only are you at risk of losing them, but they could also do damage to your brand by sharing their bad experiences with others.

So, if you have 100 clients complete your survey and the results are like this:

10 Detractors (-10%)

50 Passives (disregard)

40 Promoters (+40%)

Then your NPS would be 30. Is that any good? Statistically, it’s at the low end of good, but it really depends on the industry.

There are a number of NPS benchmarking studies out there but none specifically on financial advisors. Using the benchmarks of SMBs (small/medium sized businesses), Consulting, and Insurance, an “average” NPS would be in the low to mid 30’s. So, to be exceptional, the number would need to be >50.

Why is NPS important?

NPS not only helps you measure if your clients are happy, it also can help you grow your business in the most efficient and enjoyable way - through referrals. More pragmatically, here are some great ways to use NPS for financial advisor-client retention.

1. NPS helps measure loyalty, which influences

retention, which increases LTV (lifetime customer value)

An often overlooked, but incredibly powerful metric when assessing the health of your business, is CAC/LTV ratio (cost of client acquisition to lifetime customer value). When you have happy clients that refer more clients to your firm, it lowers your acquisition cost. When you have happy clients that stay with you a long time, you increase your LTV.

While simple, many advisors don’t track either metric and don’t have systems in place to optimize them. The irony is that when those metrics are great, clients are really happy, so a very healthy business typically equates to really happy, successful clients.

2. It will make you a better advisor for your clients

As painful as it feels to get negative feedback, a proper NPS survey allows clients to tell you, in advance, when they aren’t happy. Unlike asking people something face-to-face, where most people feel uncomfortable giving honest feedback, a digital survey allows people to select an honest answer and give direct feedback.

In many cases you’ll find clients have a few concerns that you didn’t even know existed. More often than not, a simple phone call to clear it up will go a long way. You may even turn someone from upset, to incredibly happy simply because you asked, and took action to help them with their concern.

3. It boosts referrals, with no awkward conversations

There’s not much more cringe-worthy than asking for referrals or being asked for them. Especially when using the “we get paid in two ways” sales technique.

Fortunately, a good NPS process automatically makes it easy to ask for referrals from your happiest clients and helps you learn how to find clients as a financial advisor. Consider the following:

- More than 80% of happy clients are willing to provide recommendations.

- Nearly 70% of survey respondents are more likely to purchase a product or use a service if a friend talked about it on social media or by email.

- Referred clients have a 16% higher lifetime value than others.

In a classic NPS survey you ask a single question like this, “On a scale of 1-10, how likely are you to recommend us to a friend?”.

When someone selects a 9 or 10 (the Promoters) you then redirect them to a simple web page that thanks them for the positive feedback, then gives them opportunities to make referrals. There are a lot of different possible actions, anything from an email connection template, a social share, or a testimonial/online review (once/if they are allowed).

Referral marketing can be a symbiotic arrangement between advisors and clients, but you need to make sure you have happy clients first, and NPS results can help identify them.

As advisors, we should be doing work that helps clients live happier lives. While there are a lot of hints as to whether or not we’re succeeding (the hugs, the holiday cards, etc.), there are also simple tools we can borrow from other industries to ensure it. We can turn detractors into fans and learning moments, and we can reward and replicate our happiest clients. Everyone ends up happier, together.