Design thinking is attracting the attention of many different types of businesses, including financial planning services.

At its core, design thinking is a human-centered approach to new ideas. This method of innovation is focused on understanding the end user’s needs, quickly prototyping, and developing new ideas that will change the way you create and deliver products and services.

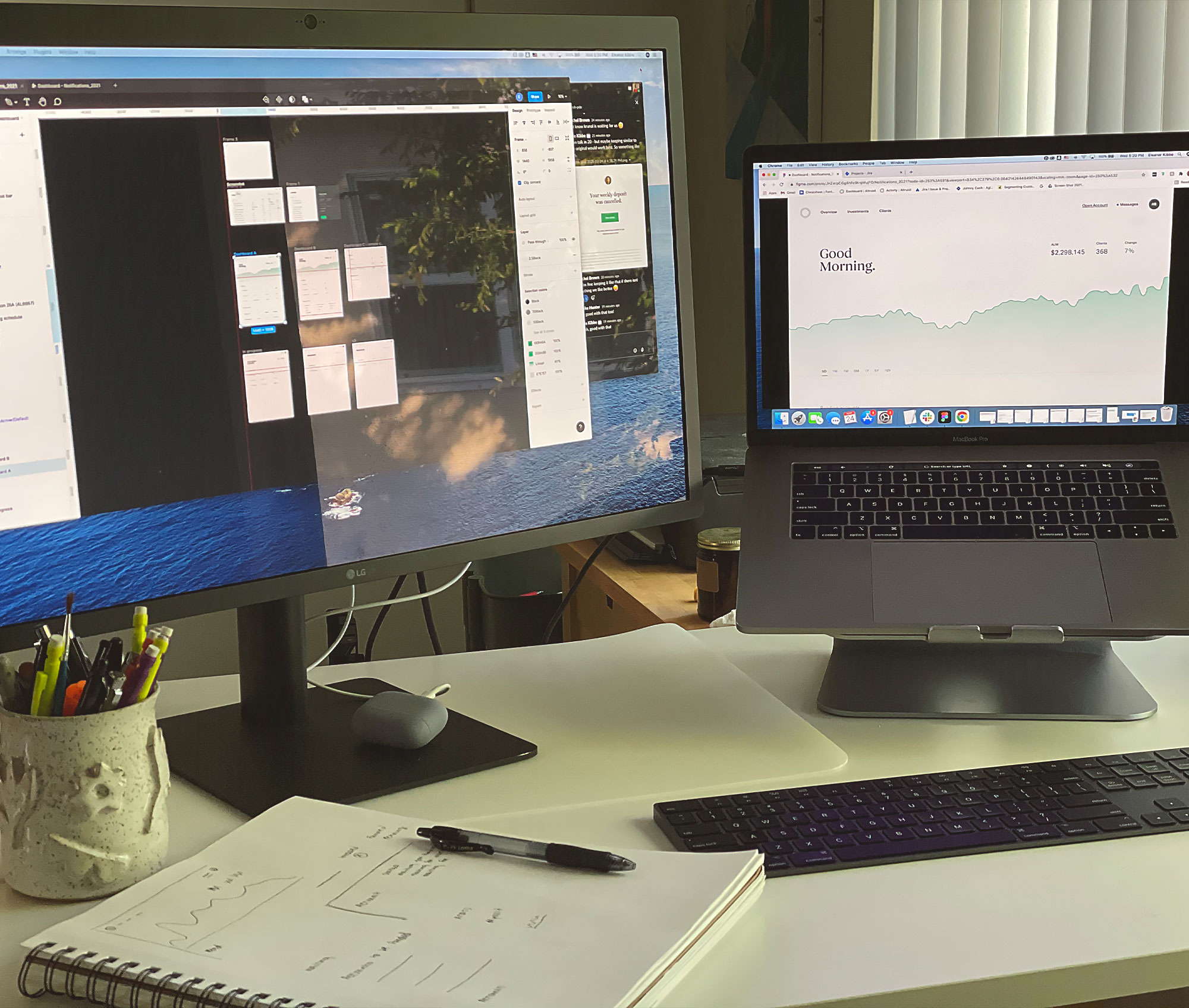

Product designers use this approach to develop seamless experiences and intuitive designs. Our very own Product Designer, Ellie Kibbe, joined me on Grow to share what role design plays in capturing your clients’ attention and how to incorporate design thinking into your business strategy.

She shares how the design thinking process combines empathy, creativity, and logic to solve complex challenges through interface design, user research, and experience. So, how can financial planners adopt a design thinking approach in order to grow their firm?

5 Steps to design thinking for financial planners

1. Empathize

Start with empathy. Getting to know your clients as people—beyond their financial goals. You might unearth that a client is an avid wine collector and has intentions of selling or trading their stock, but might not have considered the financial implications that could result from this. Or perhaps they have personal goals tied to retirement, like owning a bed and breakfast. Your conversations and planning strategies might drastically pivot when you discover more dimensions to your client’s personality.

2. Define

This stage of the process is focused on bringing clarity to the challenge at hand in order to develop a problem statement that is actionable. For example, are you running into multiple instances where clients are forgetting to sign something or are missing where it is listed. This might a clue on poor design, but requires further research to clearly define the problem. When you're able to make sense of the issue you’re trying to solve, you can make way for ideation.

3. Ideate

Ideate is the mode of the design thinking process in which you concentrate on idea generation. In this stage, the more ideas, the better! So brainstorm, workshop, and start polling. The top few ideas can be pushed into prototyping.

4. Prototype

While this step in the process might seem development heavy, it should be relative low resolution models that simply get the idea across in order to receive feedback from users and peers. This could look like a wireframe, a role-playing scene, or a mock-up. The prototype should be built with the end user in mind and intend to bring up questions.

5. Test

Now is the time to gather feedback and address it. This could potentially loop you into one of the previous stages of the design thinking approach, and that’s exactly why this is an iterative process which can result in the best possible outcome for your end user—in most cases, your clients.

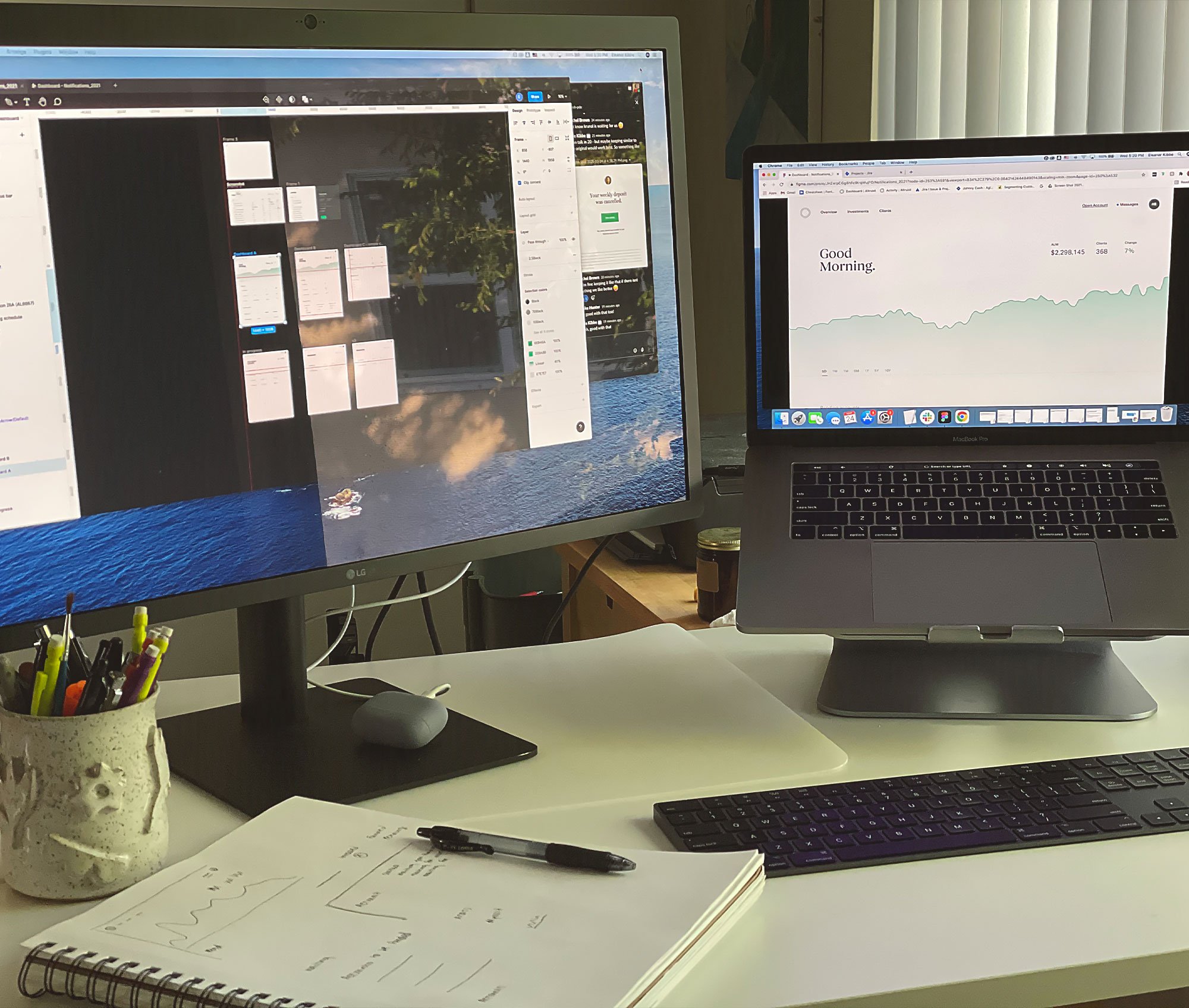

In today’s competitive and customer-centric landscape, financial planners must understand the client on a much deeper level to come up with more innovative solutions. This is exactly why Altruist sits at the intersection of design thinking, technology, and personal financial planning.

As an advisor, you want to be able to provide your clients and prospects with polished technology that also has a human behind the platform. Leveraging a technology partner that allows you to provide your clients with elegant reporting, seamless design, intuitive interfaces, and even an app that goes where they go, you’re able to keep up with the demands of digital consumers.

The risk of not using technology is just that—a risk. Your clients have specific needs, and design is one of them—not meeting these requirements simply means you run the risk of losing these relationships to financial planners that do meet these demands.

Disclaimer: The views expressed in this video by the participants are solely their own and do not necessarily reflect the views of Altruist Corp or its subsidiaries. No compensation was provided.

|