I love meeting great financial advisors. Advisors who care about their clients and their craft. Advisors who invest in their education so they can provide the best possible outcome for their clients and care deeply about the experience those clients have working with their firm.

While there are a lot of bad financial advisors out there, I believe there’s a renaissance of great advisors eager to help people, do business the right way, and clean up the (deservedly) bad reputation some financial advisors have created.

There’s just one problem.

Even great financial advisors who truly put their clients first, struggle to get new clients.

It’s odd (and sad). There are thousands of terrible advisors out there enjoying great personal success at the expense of their clients.

Why can’t the good advisors win? Why can’t investors see how harmful the bad advisors and their poor planning and unfit products really are?

Part of the problem is the shortage of great advisors. There are simply far too many people that need help than there are great people to help them, so lousy financial advisors have it easy. Hopefully, the next generation of great advisors helps solve that problem.

Part of the problem is the shortage of great advisors. There are simply far too many people that need help than there are great people to help them, so lousy financial advisors have it easy. Hopefully, the next generation of great advisors helps solve that problem.The larger issue is the fragmentation of good advice. It’s not easy for financial advisors to deliver a great client experience (yet). Specifically, independent financial advisors.

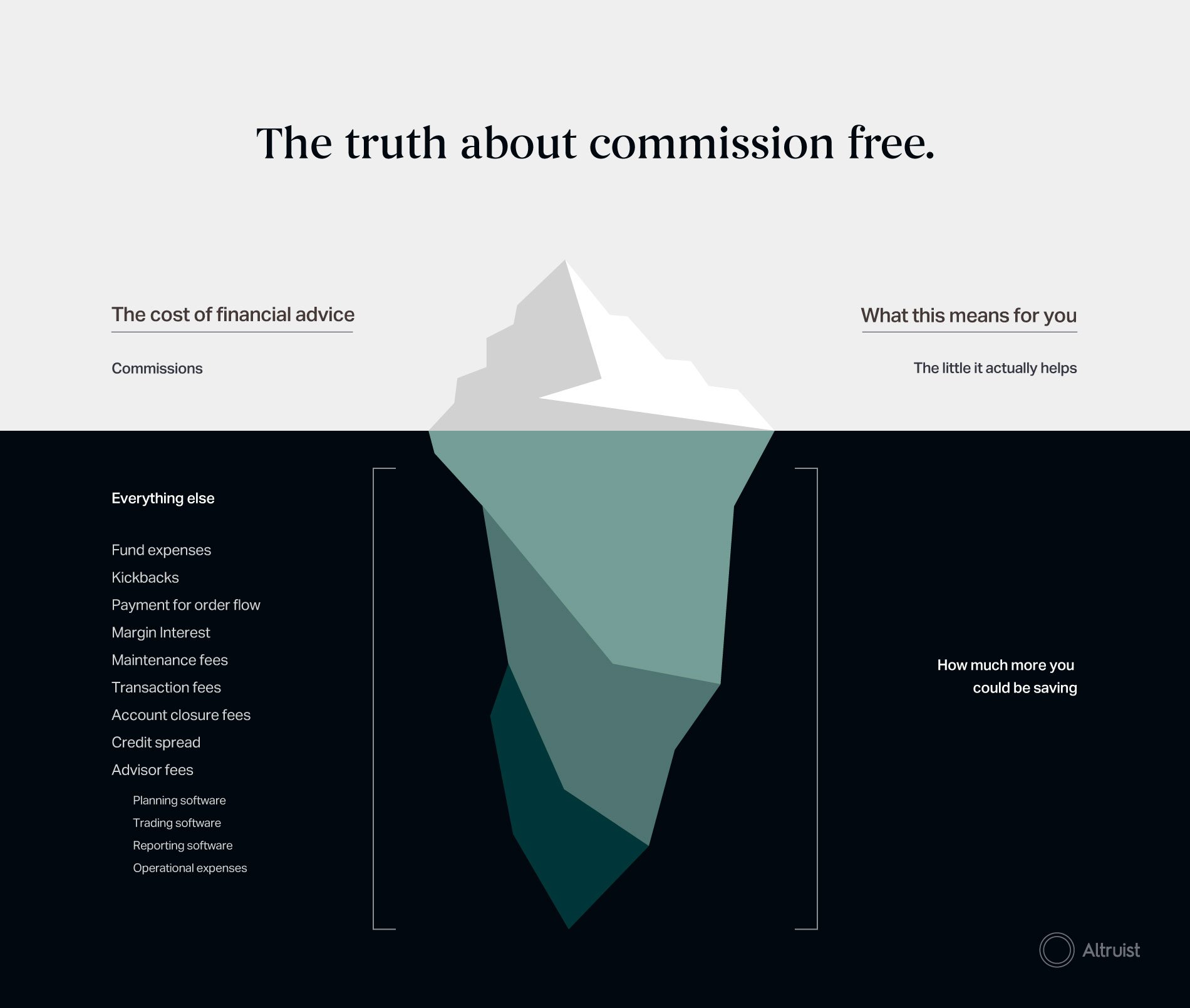

Costs are high. Financial planning has been bastardized to be used as a sales process.

Tax planning is rarely scalable. Vendors have little competition or impetus to be great.

It’s hard to be a great advisor and provide a truly great experience for all clients, all the time.

In virtually every other industry (other than healthcare, which is even more broken than financial advice) user experience (UX) has seen a massive improvement and become a central focus.

The reason we become raving fans of products and companies we use can be attributed to the experience of using them.

If you’re a die-hard Apple fan, it’s probably because you love the simplicity and intuitiveness of the product. Maybe even how it looks and feels.

If you own or have ridden in a Tesla, you probably love it. They’ve reinvented the entire automotive experience to be more user-centric.

If you look at the apps you use for hours every day, they succeeded over their competitors because they provided a more engaging experience (for better or for worse).

When you walk into your favorite store, especially premium or specialty brands, you’re more captivated because of their highly curated customer experience. Everything you see has been thoughtfully planned and everyone you interact with has been thoughtfully trained to create a consistent, desirable shopping journey.

People love brands for the full experience of being a follower.As a financial advisor, if you can master the UX for your clients, you’ll have as many of them as you want. If you can deliver UX at scale, you’ve found the holy grail.

People love brands for the full experience of being a follower.As a financial advisor, if you can master the UX for your clients, you’ll have as many of them as you want. If you can deliver UX at scale, you’ve found the holy grail.So, how do you do that?

Let’s look at 4 ways we can create a beautiful client experience as a financial advisor.

1. Know what your clients really want

Behind most great companies, products, or apps created, there’s a Head or VP of Product. In technology companies, this person speaks to the end user and distills their needs into the most important product features that will solve the pain points of those customers, then works with the engineering team to build it.

Listen to your clients.As a financial advisor, we should think about our business the way a great product manager thinks about product development. We need to talk with our audience to better understand what they really want.

Listen to your clients.As a financial advisor, we should think about our business the way a great product manager thinks about product development. We need to talk with our audience to better understand what they really want.When we do this, what we find is enlightening.

Most clients simply don’t want to worry about their money. They want to know that the return they’re getting is fair, that the fees they pay are within reason, and that they’re avoiding unnecessary taxes.

If you serve a niche market segment your client needs are obviously more refined but their end game is typically the same: they want to live a good life without worry.

2. Communicate better

Time and time again, studies show that the number one reason clients fire their advisor is due to the advisor’s failure to communicate effectively.

This doesn’t mean you should spam your clients with anything and everything under the sun. Communicate regularly about the things that help them worry less about their money.

If your clients want a cheeseburger, don’t give them a salad. Give them a big juicy cheeseburger. Oftentimes clients just need regular reminders of the value of your advice. Don’t send confusing market updates with a bunch of jargon they can’t understand.

If your clients want a cheeseburger, don’t give them a salad. Give them a big juicy cheeseburger. Oftentimes clients just need regular reminders of the value of your advice. Don’t send confusing market updates with a bunch of jargon they can’t understand.Keep it simple. Let them know when you’ve reviewed their financial plan and remind them they are still on track to reach their goals. If the market drops and you’re able to save them money on taxes to help offset the temporary decline, let them know that too. If you find a way to reduce fees with a smarter allocation on their 401(k) (even though you don’t charge for it), don’t be shy about sharing the news.

I realize this sounds great and easy, but is not realistic for most. But know that Betterment, Wealthfront, and other robo advisors are already doing this. They’ve codified financial analysis and the delivery of the news investors care most about.

Don’t worry. You’ll be able to too. We’re building it for free at Altruist. ;)

3. Simplify

People don’t rave about the complexity of their favorite products or services. At worst, you just know something works. At best, you flat out love using it.

Take a look at what you do in your business and the work you do for your clients. Like the clutter in the rest of our lives, only 20% or so is probably necessary.

Practically speaking, this means we are often using too many vendors, too many products, have too many different types of clients, and for some, too many employees. It’s hard managing all of this. If you simplify your business you will do better work, have happier clients, and create a better life for yourself.

4. Embrace automation

Most great financial advice requires a lot of manual labor. Sometimes it’s just a lot of time for a human to input data into sluggish software. But it’s still a waste.

Is your client’s journey seamless and enjoyable? In a great user experience journey, you should be able to reach your goal with the least amount of wasted time (and money) as possible. Things should just work.

Is your client’s journey seamless and enjoyable? In a great user experience journey, you should be able to reach your goal with the least amount of wasted time (and money) as possible. Things should just work.I’m not sure who started using the terminology “advisor technology stack,” but it’s horrible.

You’re likely a small operation with a simple goal of helping your clients succeed. You should not have a “stack” of technology weighing your business down. The only experience this creates is a clunky, unpleasant, and expensive one.

Worse yet, the options available to you aren’t great. Small vendors have lousy prospects for growth, so typically have large margins or a bad product (or both). Large custodians have little competition, so have a great combination of fat margins and little impetus for innovation.

Advisors and their clients deserve better. Something as simple as bundling tech (not stacking) and embracing automation will help. It’s nearly impossible to automate and improve our services if we are managing a complicated group of barely connected vendors. Cut the fat where you can.

It’s important we have a strong foundation. It makes little sense to show how to get more great clients if we don’t have the expertise and infrastructure to deliver a phenomenal experience.

If you haven’t already done so, be sure to subscribe for Altruist updates below. Our software addresses many of the challenges advisors face in running a good business, learn more here.

To better and smarter advising,

Jason Wenk